What is Hail Damage?

There is one thing about the weather that it is always unpredictable. Any thunderstorm which produces hail that falls to the ground is called a hailstorm. Hail damage is one of the costliest weather disasters to affect lives, infrastructure and businesses across the US. Residential and agricultural losses are in billions of dollars each year in the US.

Types of Hail damage:

ROOF DAMAGE: The most common damage that householders face during a hailstorm is roof damage. These damages are hard to detect, making repairing a very tedious process. Most of the times, the damages go undetected which results in water leakage during rainfall. It is important to have a full inspection for your roof after a hailstorm.

SKYLIGHT DAMAGE: Skylights are prone to heavy damage during hailstorms. Skylights are most often damaged directly on the glass or on the seal surrounding the glass.

WINDOW AND SIDING DAMAGE: Hail falls at angles sometimes, causing windows and sidings to crack. If there are holes, chipping or cracking on the edges of windows or sidings, they are signs of hail damage.

AUTOMOBILE DAMAGE: Vehicles, often parked in uncovered parking spaces tend to bear the brunt of severe hail damage. Hail can easily damage glass, plastic, and metal surfaces on a vehicle. Dents and cracks on a vehicle’s body are the most common damages.

PROPERTY DAMAGE: Not only can hail damage your house but it also has the potential to destroy your yard. Trees and plants that get in its way are bound to be destroyed. Branches of trees can fall off from the weight of the hail and accompanying wind. Hail can also damage exterior AC/HVAC units which can be dented and can absorb water from the hail once it melts.

Adjusting hail related claims:

Some issues that may arise during adjusting hail related claims could be:

Inflation of Premiums: Always scrutinize the amount you pay for each premium and ensure that its sum over the years is not higher than the original quote that was offered to you.

Overpaying: Always take time to check rates for monthly adjustments that your insurer is using to adjust premiums. At the end of the year, the annual premium should match your original quote.

Too many bids being controlled by one agent: This results in a lack of competitive bidding process which reduces the highest possibility for savings for a customer.

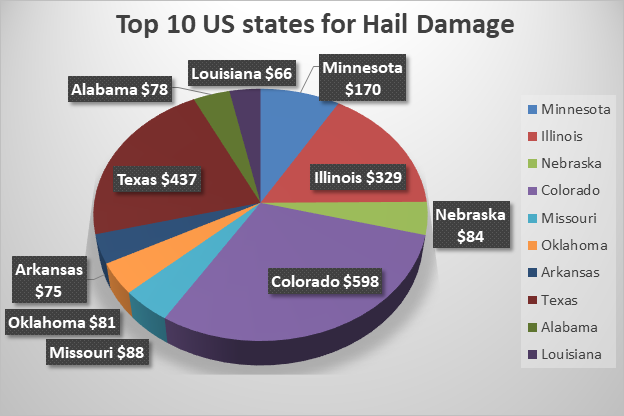

Top 10 States for Hail Damage: USA

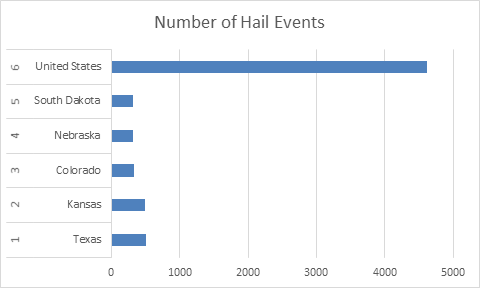

These are the top Five States for Major Hail Events, 2018 (1)

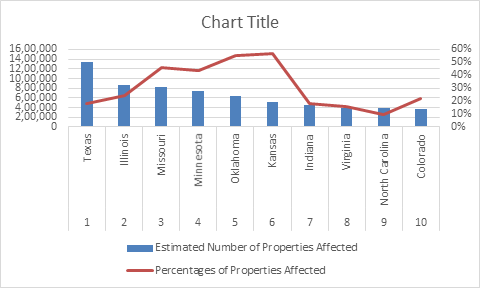

Data for the top ten states which suffered major hail damages, 2018 (1)

Texas which ranked first for average losses per year has accounted for more than 20 percent of all hail claim losses since 2000.

Minnesota had the second-highest average annual loss since 2000 and the sixth-highest average claim severity.

The Verisk report found that there was a clear increase in the number and severity of hail claims during the past six years.

2011 was the first year to break the 1 million claims mark.